- The SatoshiConomy JRNL

- Posts

- A pleb's Treatise

A pleb's Treatise

A Reveal Of Inevitable Monetary Disruption (A Short Book)

pleb: a citizen or commoner; a member of the plebeians

Intro:

i'm with you. i'm not aristocracy or of the elitists or rulers.

i'm one of “you.” As a pleb, i do NOT imply a poor lower class, or powerlessness or insignificance…quite the opposite. As plebs, we are of the most common group of people! Today, plebs are a “woke” hoard united in a cause to effect the global disruption of money…Yes, money.

This inevitable global monetary disruption is only possible now because of the harnessing of the speed of light and light energy into the greatest invention in history: The Internet. The age of The Internet made the world much smaller, as it enabled peer-to-peer communication with someone thousands of miles away as if they were in the same room. Thus, since money is fundamentally a language of P2P value communication, digital monetary protocols on The Internet have enabled powerful new options for exchanging and communicating value for billions of people. This changes money itself.

And so i begin…

Cryptocurrencies are the most significant monetary innovation since the use of the word “money.”

It’s seems that systems of money pre-dated language, because the earliest known writings are believed to be ledgers of account recording debts and receivables…

Cryptocurrency technology is BY FAR the most quickly adopted technology in history. As of 2021, cryptocurrency adoption globally was estimated to be increasing by @ 120% p/year, which is almost double the rate of adoption of the previously fastest adopted technology known to man: The Internet.

Although it’s practically impossible to get a precise calculation of individual adoptees, estimates are that there will likely be 150 million individual Crypto adoptees globally by the end of 2021. Assuming only 100% increase annually going forward, this means that by the end of 2024, the world will see over ONE BILLION Cryptocurrency adoptees.

An important fact and evolutionary tale inherent to the unprecedented growth in the adoption of Cryptos is the fact that previous to Cryptos, investing in a promising product was only an opportunity for the rich or the elites or venture capitalists or bankers or family offices or hedge funds or the highly connected or accredited investors...and only then, after 100x gains had already been made, only then could the plebs get involved. Not so with Cryptos. Its market began with small retail investors and took only twelve years to reach $Trillion corporate boardrooms. plebs are nimble, corporations and bureaucratic behemoths…not so much. 2022 will be an historic year for Cryptos, because adoption of Cryptos by the largest corporations and thus the highest echelons of society, has evangelized Crypto’s credibility to the entire world.

And so i begin…

For the first time in history, there exists a money which decentralizes the powers and controls of its very own monetary policy.

This “world's first money” stands in direct contrast to every noteable form of money that's ever existed in history. In today's age, especially since February of 2020, there’s an historically unprecedented level of money printing of nation-state currencies all over the world bringing an overabundance of currencies online, all following the lead of the monetary policy of the world reserve currency, the U.S. dollar.

And this unprecedented money printing is all coincident with the unprecedented Black Swan Event of global lock downs. This money printing is supposedly a humanitarian attempt to front-run and soften the devastating effects of a global catastrophe.

It is now more important to the greatest number of people ever (the plebs), to understand that there is inevitable monetary disruption on a scale never seen before. 2022 will be a pivotal year. So i begin this treatise with a telling and historic quote:

“There is an infinite amount of cash at the Federal Reserve. We will do whatever we need to do to make sure that there’s enough cash in the banking system.”

-Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, March 2020

Money printing in a fiat currency world (currency not convertible to gold), means that U.S. government spending is paid for by issuing brand new, never spent dollars into the economy as debt on the nation's checkbook. This new supply of currency quickly leads to a direct loss of the dollar’s purchasing power, and can only be accounted for as debt on a ledger, not as assets “In Gold Coin Payable To The Bearer On Demand.” Simply put, money printing is currency supply inflation. Its continuation breeds an ever-increasing abundance of U.S. dollars in the world.

Any time there’s an increasing abundance of anything, it decreases the value of that “thing.” History tells us that currency supply inflation as a monetary policy debases the currency’s purchasing power, and eventually fails 100% of the time. Conversely, if the printing presses were turned off, the dollar currency system would fail for many reasons. The long history of the inflationary monetary policy of the dollar will lead to its collapse either way.

12 Premises Of This Treatise:

1) The “Right To Property” is a fundamental human right, and property rights are foundational to human prosperity

2) Currrency does not equal money

3) Money stores the energy of value, and is a language of value communication

4) Sound Money maintains or gains value over time, and as water flows downhill, so Sound Money flows toward a good store of value

5) The C.P.I. is not the inflation rate

6) Currency supply inflation debases the purchasing power of the currency, fueling price inflation

7) Price Inflation is not necessary

8) Price inflation is time theft of the working class

9) Price inflation correlates with increased hunger, poverty, homelessness, mental illness, stress, addictions, obesity, civil unrest, crime, disease, divorce, death, suicide, violence, murder, war, and other social maladies, and can logically be construed as a tax on society

10) A high “velocity of money” is vitally important for a healthy economy, and is now efficiently achievable globally through recent internet-based Fintech innovations using blockchain technology

11) An open, global, inclusive, 24/7/365 internet-based free market with transparent internet transactions is now unstoppable, and will lead to reliably true price discovery of goods and services, more competition, and less corruption on a global scale

12) The invention of The Internet is the most widely impacting and powerful invention in human history, thus as the world will predictably continue to adopt the common-sense transformation of money onto The Internet, “The Internet of Money” will become the most widely impacting and powerful invention in human history

Could The Dollar Really Lose Its Crown As The World Reserve Currency?

As a five-year-old kindergartner in the U.S.A., i remember reciting “The Pledge Of Allegiance” every school day. “I pledgaleejance to the flag, of the night of states of Merica” is what it sounded like to me. i knew the red, white and blue flag was symbolic of our country, and somehow, as an innocent and impressionable child, that flag was sacred. It symbolized freedom, and allegiance to it promised liberty and justice for all. Freedom, liberty and justice were three big words for a five-year-old, but to me, it meant a playground, play any game you want, and we all play by the same rules. Game on!

Fast-forward several decades and, due to the public and open internet and the ubiquity of cameras and accountability, there's a much higher awareness and sensitivity to freedom, liberty and justice for all the world's plebs, and for five-year-olds as well.

What do “freedom, liberty and justice for all” have to do with money? Well up until now, not very much. Throughout history, practically every nation's monetary policy has been designed, issued and controlled by the elite ruling authorities of the empires and nation-states which issued them. Thus, monetary policies throughout history have largely been designed by small powerful groups as a mechanism favoring those in control.

Yet in this decade, plebs will (continue to) show that “freedom, liberty and justice for all” have everything to do with money. Right now for the first time in history, there exists the world's first money designed to decentralize the powers and controls of its very own monetary policy. Via an internet-based mathematical design, this money exists as an open, global, borderless, transparent, public digital monetary network with a limited supply. And this money requires no permission to adopt it. It's called, “Bitcoin.”

With a $50 phone and an internet connection,

anyone anywhere is enabled to participate in the Bitcoin Network on a global and verifiably correct public monetary ledger. This digital monetary network is provably correct, and has an inherently designed tamper-proof record because it cannot be secretly altered. This eliminates counterfeiting, fraud, and the “double-spending” of any bitcoin. Bitcoin is truth and honesty in money, establishing monetary justice for all participants. What a concept!

Within this peaceful and brave new world of P2P internet money, Bitcoin thrives on:

*freedom (free market dynamics),

*liberty (permissionless participation)

*justice (honesty and accountability in money via public internet ledgering).

Already, Bitcoin has become the quickest entity in history (by far) to reach a $1 Trillion valuation. This rate of growth was never possible in a pre-internet world. The network effects inherent within an electric, digital, internet network enables “virality,” which exponentializes the speed of growth and the number of customers attainable.

See this optic showing trillion-dollar success stories, all reached since 2018:

Beyond Bitcoin, “DeFi” is blazing a new trail in an entirely new industry which will birth many trillion-dollar entities during this decade.

Decentralized Finance, or “DeFi,” owes much to Bitcoin's success, mankind's natural ability to innovate, and the inherent nature of money to flow into the best store of value. DeFi is a spin-off juggernaut financial industry which has emerged in recent years, and has grown from about $1 Billion TVL (total value locked) in June of 2018, to reach almost $100 Billion TVL only 39 months later, in September of 2021. (Click here to see public data).

Within the DeFi industry is a new and thriving global liquidity market which rewards stakeholders with interest percentages in exchange for staking. Yielding percentages are attainable through many DeFi offerings at thousands of times greater percentages (not a typo) than those offered by traditional banks to their savings customers.

Another Emerging Industry Blowing Away The Naysaying Boomer Generation Is Called NFTs, Or

non-fungible tokens where, for example, artistic digital representations of apes (yes, like a gorilla) have sold for $5 Million+. The highest priced single NFT sold for almost $100 MILLION!!! In case you think this market is bogus, consider this: Many people cash out their asking price immediately. Children are making more money than their parents via NFTs and internet gaming play-to-earn (p2e) competition. Even five-year-olds understand this.

At this pivotal moment in history, the world teeters at the tipping point of an historic transfer of wealth. Leading economists, statisticians, researchers, thought leaders, historians, geo-political leaders, financial and monetary experts, and yes, even bankers have been warning about this transfer of wealth for over two decades. And this prophesied historic transfer of wealth is happening little by little, and then eventually all of a sudden. 2022 will be a pivotal year, and this will be proved out by the markets globally.

As A Global Digital Monetary Network, Bitcoin Reigns Supreme

Bitcoin has monetary designs never seen before with money. For one, it has “absolute scarcity.” In other words, Bitcoin has a limited supply which is a pre-set, mathematically programmed total of 21,000,000 bitcoin to ever exist, which will happen @ 2140 a.d. Bitcoin's mathematically programmed internet protocol will terminate the mining of any more bitcoin after 21,000,000 bitcoin are mined. As of writing, there’s been almost 19 million bitcoin mined. Click here for the present amount: bitinforcharts.com/bitcoin.

The value of this absolute scarcity design feature cannot be overstated, especially when you compare Bitcoin to gold.

Before comparing Bitcoin to gold, let’s remind ourselves of this: It’s estimated that 95% of all gold EVER above ground has been confiscated! Gold has been treasured as the most prized possession for most kingdoms, empires and nation-states throughout history.

Gold, considered the world’s best store of value for 5000 years, has an estimated 2% annual supply inflation. This suggests that one’s gold holdings as a youth will shrink to a small fraction of its original value as an elder…over the span of just one lifetime. So Bitcoin's “absolute scarcity” is arguably an extremely valuable feature. Plus, Bitcoin requires none of the expense related to gold for bullets, bombs, guns, guards, gates or vaults. In this sense, Bitcoin does gold better than gold does gold…No more “Mission Impossible,” “007,” or “Jason Bourne” trilogies. Bitcoin will put Tom Cruise, Daniel Craig and Matt Damon out of business! Or maybe Matt can recruit Tom and Daniel to do intrepid Crypto commercials just like him. ROTFL

Here’s a futuristic thought when comparing Bitcoin to gold: Try sending gold to Mars once it’s colonized. Good luck! But economies of scale can begin with the size of a colony on Mars as well as the size of a kindergarten class, where bubble gum and marbles have been known to become money. With my mobile phone here on Earth, i could send bitcoin to my friend on Mars when he needs more money to buy bubble gum, and he’d receive it on Mars by this afternoon. In this way, i could also theoretically fund my friend’s campaign to unseat Elon as the Emperor of Mars. And we could do that with OR without Doge Coin. May the force be with you…

Another unique monetary design feature of Bitcoin is its “terminal inflation.” At present, Bitcoin's supply inflation rate is under 2% p/year, is halved every four years, incrementally reducing over the course of the next 120 years, and will become terminal. See here: BitcoinHalving.com. The next bitcoin halving will be @ April, 2024, and the final 21,000,000th bitcoin will be mined in 2140. Stated in another way, one bitcoin today is 1/21,000,000th of the total supply, and in 120 years, one bitcoin will be that same 1/21,000,000th of the total supply…kinda eliminates all question and confusion and tends toward certainty, credibility, and reliability as a unit of account. It’s no wonder the plebs love it. It has “street cred.”

Adding to Bitcoin's designed terminal inflation is the not-often-talked-about reality of human nature which adds to the certainty of greater Bitcoin scarcity over time…carelessness. People who are careless with their ownership of bitcoin can lose their “private keys” to their bitcoin, losing their bitcoin forever. “Not your keys, not your bitcoin.” If you don’t know what that means, stop reading this “A pleb’s Treatise,” and enter that into your browser.

It's estimated that between 4-6 million bitcoin have been lost already because of carelessness, and this mainly in the early days of Bitcoin’s low price when less care was afforded to it's custody.

So, its reducing supply rate adds to upward price pressure even as demand for bitcoin increases. Bitcoin is a “once-in-infinity” opportunity.

As if that weren’t valuable enough, Bitcoin’s design improves traditional money from:

*analog to digital

*snail mail to light-speed

*3-7 day cash settlement finality, to same-second irreversible transactional finality

*physical to weightless

*slow and suffocating velocity of money, to lightning speed velocity of money

*third-party rent-seeking transactions, to inexpensive P2P exchanges…even for billion dollar transactions

*9-5 service not including weekends and holidays, to 24/7/365

*closed markets, to borderless and free-markets

*no independent auditing, to a public and transparent internet ledger updated every 10 minutes

*centralized monetary designs, to decentralized and autonomous mathematically programmed money

*manipulated markets empowering immunity for a few, to less manipulation and universally verifiable honesty in transactions

*money controlled by rulers, to money controlled by rules

SatoshiConomy's note: Those who don't believe these innovations are disruptive to the traditional financial system are:

1) Blinded by their immersion and pride in a centuries old traditional financial system, ignorant by choice, indignant of the millennials, fearful of change, without logic or a “first principles” aptitude, in ivory towers, devoid of compassion

2) Rationalizing their own cognitive dissonance against Bitcoin and cutting-edge Fintech because they are heavily invested in dollars or other fiat currency instruments

3) Aware of what’s inevitable, and are trying to stave off time while they load up on as many assets, land, gold, art, munitions, and dollars AND Bitcon as possible before the inevitable

Trifecta Tsunami

Today, we’re at a Trifecta Tsunami of:

*population,

*technology, and

*monetary upheaval.

In other words, today, billions have a hand-held device which now enables them to be their own global bank president…taking notice Mr. Neel Kashkari?

In an instant, a peasant who is hours away from the nearest bank, can now participate in commerce with someone on the other side of the world without permission, and for practically no transactional cost.

…again, Could The Dollar Really Lose Its Crown As The World Reserve Currency?

This is probably a scary thought for most, since most of us were born after the 1944 Bretton Woods Agreement officially crowned the dollar as the world's reserve currency. It's all we've ever known. Change doesn’t happen easily with matters of such great importance.

A transition to a new world reserve currency is not only possible, but has already begun. Although its unlikely for this to take place within this decade, if it does, it’ll be because of the exponential rate of the speed of change that can happen in an Internet Age. With The Internet, change changes exponentially, and faster than humans usually predict. It’s been said many times that, “Humanity’s inability to understand exponentials is one of our greatest shortcomings.” Others think, “Yes, this will happen, but not in my lifetime.” Still others think, “It'll never happen.”

Military Powers Back Currency

For over 2500 years, every “world reserve currency” previous to the U.S. dollar (such as the drachma, denarius, dinar, guilder, franc, pound) has had two realities in common: A powerful military backing, and a successor.

Today, the U.S. Navy monitors most of the world's trade routes. Eighty-five percent of all products sail the ocean blue. The U.S. enjoys the most dominant military firepower by far of any country. The U.S. estimates that the long-range firepower of all other countries COMBINED, is just 4% of one U.S. Navy super-carrier, of which the U.S. has eleven. The U.S. Navy's combined deck space is double that of all other countries combined! So this bodes well for the dollar remaining the world reserve currency, except that, well, the leading candidate to replace the dollar is in cyberspace, and does peaceful battle on The Internet without bombs or bullets.

Some say the leading candidate to replace the dollar is the S.D.R., or “special drawing rights,” the unit of account of the International Monetary Fund. The S.D.R. can be exchanged for the dollar, yen, renminbi, pound or euro. But the S.D.R. as a world reserve currency would be just another form of a centralized monetary design, vastly similar to that which a “woke” generation is now swiftly abandoning.

Speaking Of “Abandoning…”

…The above optic, based on Bureau of Labor Statistics data, graphs the abandonment of purchasing power of the U.S. dollar over the last 100+ years. Conversely, here's an optic showing the relative growth of purchasing power for those (HODLers) holding bitcoin:

The flight to a better store of value than the dollar is clearly evident right now, and for over 3 years has been trending largely into gold, led by the largest Central Banks of the world, which have been purchasing gold at historically high rates. Other sectors seeing greater inflows have been fine art, choice real estate, single-family units (can you say, “BlackRock?”) new apartment/housing complexes, tech stocks, DeFi, NFTs and bitcoin. This transition will act like the speed of contagion…slowly at first, but eventually “all of a sudden.” Yet the dollar is still by far the world's most popular currency.

Incidentally, today marks the 50th anniversary of the U.S. dollar as a fiat currency. (fiat = “by decree”) On August 15, 1971, President Richard Milhouse Nixon

announced that the U.S.A. will “temporarily” suspend the convertability of U.S. dollars into gold. Known as “The Nixon Shock,” this announcement instantly launched the U.S. dollar as a “fiat” currency, or as a currency by decree, backed by the “full faith and credit” of the U.S. government. In other words, the dollar was no longer pegged to or backed by the gold standard. Fast forward 50 years, and we’re seeing massive signs of distress and cause for alarm.

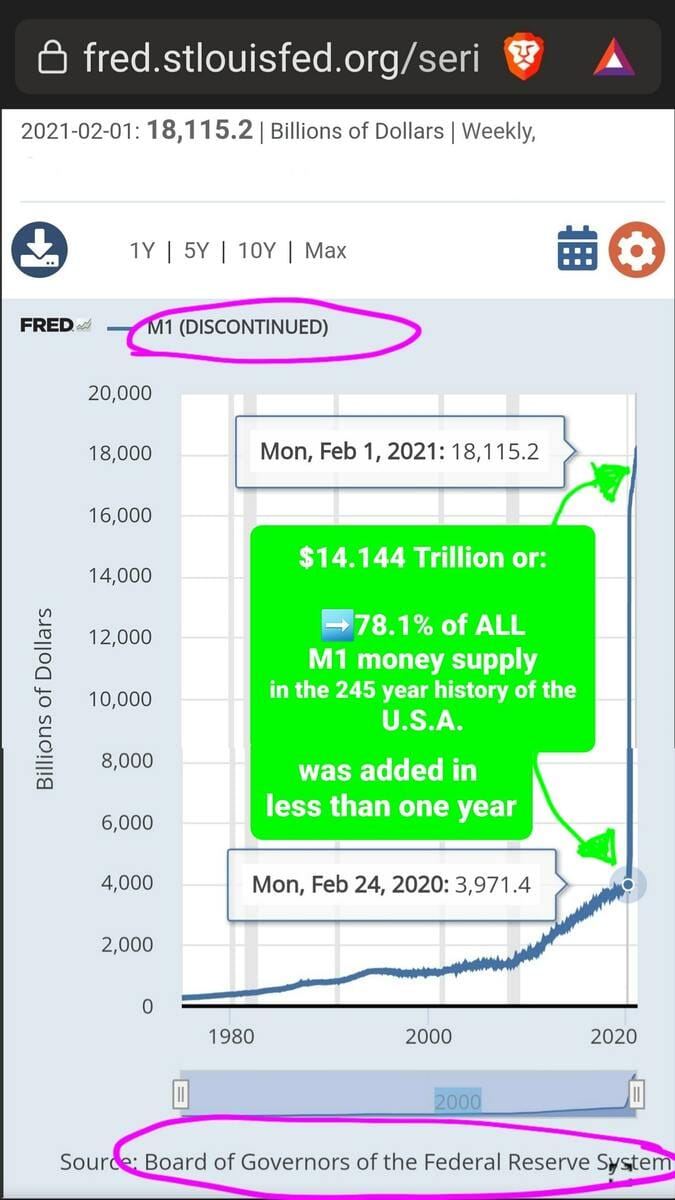

The Fed Discontinues Tracking M1 Money Supply

What i'm about to describe to you ought to shake you to the bottom of your feet…

78.1% of All the M1 money supply ever in existence in the 245-year history of the U.S.A. was added in less than one year from February 2020 to February 2021.

M1 is a narrow measure of the money supply that includes currency, demand deposits, and other liquid deposits, including savings deposits.

M1 does not include financial assets, such as bonds.

The M1 is no longer used as a guide for monetary policy in the U.S.

Simply put, M1 is cash, actual greenbacks, savings and checking account balances, and quickly liquid instruments such as money market accounts and C.D.s.

According to St Louis Fed data, $14.144 Trillion was added to the M1 supply

from $3.971 Trillion on February 24, 2020

to $18.115 Trillion on February 1, 2021,

an addition of $14.144 Trillion in a little less than one year. This data is so astounding that the Federal Reserve stopped publishing the figure publicly. Here is information directly from the St Louis Fed website:

Crickets…and i hear the voice inside my head, “There's got to be a better way!”

The Dollar Scheme

By virtue of the dollar’s operating scheme, (currency creation equals debt creation to fund today's/tomorrow's spending), the present dollar system is designed to collapse, despite having the world's most powerful military backing.

If all that is printed via bank loans and credit is paid off, the system collapses on itself as the rate of pay-off exceeds the rate of debt creation.

Few people understand this, because few people have thought this through far enough to see that if all loans were paid off, theoretically, the banks have no right to confiscation or recovery of their customer's collateralized property.

The banking industry's valuation is based largely upon the market values of collateralized property, much of which are contractual claims to ownership of homes, land, and historically valuable assets recoverable in the event of default. If all loans and credit are paid off, the banks own none of the real property; the plebs do, and the commoners prosper. Property rights are a foundation of human prosperity. This 100% opposes the bankers’ livelihood.

It’s a net positive for banks to have a customer continue on in debt, not only because banks earn interest on loans, but more importantly because statistically speaking, the probability increases for the bank to eventually own the property collateralizing the loan. Plus, since March 2020, the banks have zero capital risk of losing bank reserves since there was none required to issue the loan in the first place. Today, in cases of default, banks get the collateralized property essentially for free. Can you see that?

Today’s Dollar Requires No Energy Expense To Create

Inherent to the design of the dollar money-printing scheme is the fact that for over 100 years, the fractional-reserve banking system has grown more and more “fractional.” What this means in layman’s terms is that banks used to be “permissioned" to lend out 3 or 4 times their dollar reserves. Then it became 10 times, and lo and behold in March 2020, unbeknownst to (likely) 99.5% of all Americans, there is now ZERO dollar reserve requirement for banks to issue a loan. Dollars have never been easier to print! Dollars now require essentially zero energy value to be added to the currency supply. They can be printed into existence via debt issuance executed by a loan signature…which can now be done even without the ink from a pen, an interesting nuance.

This currency scheme has inflation designed right into it, because an inflated currency supply occurs via more debt issuance. Another way to say that is, “Currency supply inflation is designed theft via debasement of the purchasing power of the currency.” And who gets the money? Stealthily, it's whom is in the convenient position of receiving the money before prices increase. This would be the large banks, small banks, or the businesses or consumers who just received cash via the loan contract who’s ink is still drying. In this way, debt has value.

We plebs know as a fact of life, that inflation decreases purchasing power. i.e., my $3.99 from a year ago for my favorite jar of honey now purchases only that much of my favorite jar of honey, which now costs $6.85.

Ever heard of a guy named Richard Cantillon? He wrote about this inflation effect 330 YEARS AGO, and said it like this:

“The first recipient of the new supply of money is in the convenient position of being able to spend their money before prices have increased. But whoever is last in line receives his share of the new money after prices have increased.”

This “inflation” phenomena has been intellectualized for over 400 years, decades before Cantillon wrote about it. The first mainstream brand of fractional-reserve-banking has been noted since 1666. Soon after, the bankers in England saw that very rarely would a depositor come back to withdraw the full amount deposited. So they devised a scheme which essentially broke trust, as they began to see success in the practice of loaning out vastly more than what was held in bank reserves, thereby multiplying their potential profits. Fast-forward to today, and we now have zero-fractional-reserve banking, and infinite money-printing publicly discussed by bank presidents in public forums as what will be business as usual.

C.P.I. Is Not The Inflation Rate

We’re told in the media that inflation goals are 2%-3% p/year. This inflation rate target and related monetary policy strategy is guided primarily by a small group of people who are shareholders of a private entity with immunity, and which has never been independently audited. This small centralized group sets and controls the prime lending interest rate, and meets regularly to steer monetary policy. It's announced goal is said to be 2%-3% inflation p/year. It's announced as if it's good for economic growth, healthy, needed, positive, and somehow economically sound for the macro economy as business as usual. (You can't make this stuff up).

Furthermore, one of the most troublesome and misapplied financial notions in America across all classes is the practical fact that most people believe that the “C.P.I.” is the rate of inflation. The C.P.I. compiles valuable data, but to equate it to the inflation rate is one of the greatest financial misnomers in America. This deserves repeating: “The C.P.I. is not the inflation rate!” i read the 37-page C.P.I. report for July, 2021, and in it is contained a section entitled, “Brief explanation of the CPI.” It’s well over 3000 words, and this is “brief.” Obfuscation much? The C.P.I. is much more complex than most people are aware of, and it reports on hundreds and thousands of items.

What Is Inflation?

i'll begin to answer that question by saying what inflation is not: Inflation is not necessary.

Inflation in America has historically been a very carefully crafted economic scheme, resulting from a monetary policy design which gradually increases the currency supply in the economy. Inflation is a form of monetary magic, causing the disappearance of dollar value for plebs…not in an instant or with the wave of a magic wand, but with the stealthy blanket of time, which blindfolds everyone, and takes months for that disappearance of value to reappear over the course of months in another form…in the form of higher prices. Wait…what?

Inflation is monetary magic which causes value to disappear into the hands of the magician without anyone noticing until months later, as everyone else sees their lost value reappear in the form of higher prices and less purchasing power. Abracadabra, you now have lost dollar purchasing power in the form of needing more dollars to buy the same item.

On the magician's side of this magic trick, the very few who are close to the money printer can actually turn the lost value of others into money by siphoning value off the top of an inflating economy before it bears higher prices. These very few are able to essentially front-run inevitable price increases by spending, buying and investing “early.”

Inflation is not a simple concept. Inflation has layers of complexity because of the many factors which can exert inflationary pressure such as monetary policy, media narratives, politics, societal trends, regulations, civil unrest, supply-chain interruptions, catastrophic weather, war, or the proverbial “Black Swan Event.”

From a macro viewpoint, one can quickly see how powerfully these complexities serve to cloud the vision and distract the attention of the masked masses from seeing how inflation happens, much less able to collectively do something about it. plebs are busy with the ever-increasing time demands required to make more dollars to pay higher bills.

When only measuring the two manipulatable factors of interest rates and currency supply, inflation is still difficult to quantify in the physical, because it results as a function between time distance and the amount of currency supply increase within an economy. In other words, inflating the currency supply doesn’t result in immediately higher prices; price increases happen gradually, as a sort of domino effect over time.

Price inflation is also insidious in nature, because practically everyone experiences inflation negatively, weeks and months after the designed currency supply inflation occurs, resulting in the debasement of everyone's purchasing power. This of course is long after the first recipients of the newest round of money printing have already bought, spent, and invested. The very “few” are in the positive position to capitalize on inflation immediately before it happens by “pre-purchasing” equity and the practical certainty of soon-to-be-appreciating asset prices.

True Inflation Rate

The true inflation rate is different for every individual, and is mostly indicative of say, around 10-12 items per month: Food, clothing, rent/mortgage, utilities/energy, medical expenses, insurances, transportation, communications, entertainment, gadgets, miscellaneous. These undoubtedly account for the vast majority of expenses for a wide swath of people, with likely 20-30 items comprising 95-100% of one’s expenses.

So although a wide swath of people may experience similar rates of inflation, differences can vary widely, depending on one's spending habits, locale, lifestyle, age, health, status, financial portfolio, and ah…proximity to friend’s in high places.

The C.P.I. is commonly and almost universally referred to as an official bargaining data point in annual wage negotiations for individuals as well as union labor and collective bargaining agreements. The C.P.I. is also the official instrument used to determine the rate of increase in payments to Social Security recipients. Incidentally, the formula to determine the C.P.I. has changed several times since 1980 so as to calculate a lower rate of price inflation than previous C.P.I. formulas. Consequently, a viable objective argument for why the C.P.I. calculation changes is so that the balance sheet for entitlement payouts to Social Security recipients would be less taxing on the Federal Budget. See: ShadowStats.com for more independent info.

The present true inflation rate for the widest swath of people in America when including food, energy, medical and housing costs (which are measured, tracked and indexed, but inexplicably NOT included in the formulation of published C.P.I. estimates) is in the range of 14-16% p/year over the last couple years, with food costs, energy, and medical costs way above that rate.

St. Loius Fed C.P.I. data over the twelve years from 2009 thru 2020 has a published annualized average price inflation rate of 1.6%. Even a 1.6% price inflation rate means that a $1 item in 2009 cost $1.21 for the same item in 2020. An actual 3% inflation rate means that $1 in 2009 requires $1.43 in 2020. At present, if true price inflation is 15% p/year, then a $1 item requires $1.52 to purchase the same item only three years later!

Part of the cluelessness of most people regarding their lost purchasing power is the practical certainty that the vast majority of people don’t do this calculation, so as to comprehend their loss of purchasing power. They know prices are increasing, but are not empowered by quantifying inflation's total financial impact on them over time. This beckons the oft-quoted muse attributed to Henry Ford, “It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

It is the heart of “A pleb’s Treatise” to announce that what Henry Ford commented on here (understanding the banking and monetary system) has begun to happen collectively and powerfully in the minds of the largest group of people on Earth: The plebs. Revolutionary changes in banking and monetary systems are happening on a global scale right now.

Currency Supply Inflation Is Designed Theft Of Purchasing Power

Currency supply inflation is designed theft by debasement of the citizens' purchasing power. A perceived 2-3% inflation is tolerable, yet “death by a thousand cuts.”

Furthermore, the high correlation in regions of high inflation to higher rates of hunger, poverty, mental illness, obesity, homelessness, stress, civil unrest, crime, theft, addictions, disease, divorce, death, murder, violence, war, suicide and other maladies is well documented ad nauseum. Logically, these social maladies can all be construed as taxes on society.

So the dollar's demise will not be by the honorable payment of debts owed; it will much more likely be due to the proliferation of its own monetary design.

What we’re seeing in the macro-global economic environment since early 2020 is the realization by many of the world's best and brightest money managers of the dollar's purchasing power debasement through currency supply inflation. Consensus is gathering around the perception of the dollar as a “melting ice cube.” In other words, sound money is naturally flowing toward a better store of value than the dollar.

Better Indicators of True Inflation Rates

Thanks to the likes of John Williams (ShadowStats.com), Ed Butowski (ChapwoodIndex.org), Michael Saylor and his team (MicroStategy.com), and the plebs or, the woke citizens at large, a growing number of people are realizing that the rate of inflation is NOT what we’re being told (2%-3% p/y). Of course, it varies according to the individual’s nuclear economy and appetite, but generally speaking, for the widest swath of people, it's much more like 14%-16% p/y…”check in with me in a month or two so we can re-calculate, because they're printing the dollars so fast.”

One absolutely important metric to consider is the U.S. national debt level. Find out what it’s estimated to be at this moment by clicking here: USDebtClock.org. As of writing, it's estimated to be $28.7 Trillion!

Using the St Louis Fed's website here: StLouisFed.org,

Q2 2019 U.S. national debt was at $22.023 Trillion; Q2 2021 it was at $28.529 Trillion, an additional $6.506 Trillion.

This represents a 29.5% increase in currency supply over two years, or 14.77% p/y on average. Smart money managers perceive this increase in currency supply to negatively effect the purchasing power of cash, and thus dollar treasury reserve asset values on corporate balance sheets.

The active flight of corporations, family offices, hedge fund managers, sovereign fund managers and plebs on every continent in search of a better store of value than the dollar (en masse) is a massively significant indicator for the positive near-term future for Bitcoin in specific. In other words, money printing is Bitcoin rocket fuel.

Retail investors have known this and acted upon this for years now. Retail is very nimble; corporations, not so much. Strikingly though, as of August 2021, BitcoinTreasuries.net reports over sixty public/private entities with significant amounts of bitcoin (collectively $77B as of writing) as a treasury reserve asset on their balance sheets; 18 months earlier, the tally was insignificant.

Bitcoin As The Base Layer Payment Rail, And The Lightning Network As A Layer Two Solution

It's very possible BTC may become the next world reserve currency. That, of course, would happen if most of the world's peoples price goods/services in BTC.

During this plausible transformation, BTC would operate as the base-layer payment rail system in an open, global, digital monetary network on 5 billion+ mobile phones. A “layer two” payment settlement protocol known as “The Lightning Network” enables market participants and dollar holders to interoperate/participate within a global speed-of-light system on top of BTC's base-layer digital network. This dollar integrated Bitcoin network will have extremely low or next to zero transactional cost, even for billion dollar transactions, with instant cash settlement finality (within the very same second).

As our present and future children bring in the reality and the common-sensical tidal wave of peer-to-peer value transactions via true cryptocurrencies, eventually the world will prefer BTC over the dollar, bringing the dollar’s reign as the world reserve currency to an end. The important dynamic to understand here is that a Bitcoin or true cryptocurrency-based economy originates and operates as an asset-based economy. There’s no debt! The integrity of an asset-based economy is so novel in today’s world, that the ability to grasp the reality of its true value proposition has been lost over the decades of economies being operated representative of rehypothecated assets and derivative instruments.

Another way of stating this is that sound money has no sound anymore. The term “sound money” came into use to describe real, valuable money because of the sound a gold coin makes when struck in a certain way. It has a peculiar tone.

Then there will be less debt and more true prosperity, backed by real assets which store real value over long periods of time. and ownership of anti-fragile property rights performing with blockchain enabled unconfiscatability.

But you ask, what if the dollar operates as a digital currency? Wouldn't that proliferate its world reserve currency status? Well, yes, probably…assuming a world without bitcorn, which is:

*The fastest*Most secure*Most fungible*Highest performing asset*Global

*Decentralized*Without 3rd party risk*The most inclusive

*The quickest entity to $1 Trillion valuation in history BY FAR

*The most widely held asset in human history at 100+ million users

*The lowest transactional cost, as low as .1% (one tenth of 1 percent) or free

The point of this treatise is that the dollar is the most significant…until it isn't. The world is apparently deciding that now.

In this age of The Interwebs, change changes exponentially faster, and because of The Internet, global monetary change is clearly upon us right now…at least it’s clear to the hoard of plebs who realize that Bitcoin is also a movement. This is the first time in history when there exists a truly open, transparent, inclusive, permissionless, global monetary design without borders, has no debt, is identity agnostic (anyone is welcome), can achieve cash settlement finality instantly, acts as a store of value, enables unconfiscatable real property rights, and is all rolled into one.

The dollar does not, cannot, and will not compete as a world reserve currency sooner than we may think.

Please feel free to leave a comment as your response, a reaction, or about something i missed, or a mistake i may have made, or something you would add. Comments and contrarian thought are helpful to promoting further depth, discussion, and development of ideas and understanding. Be kind.😁

100% of SatoshiConomy profits go to charity and green-energy projects enabling off-grid lifestyles. I wish you well, i wish you wealth, i wish you health, and until next time, Peace! 😎

D.Y.O.R. Only YOU are 100% responsible for your own financial choices.

#LoveAllServeOthers #plebsTreatise #AplebsTreatise #plebTreatise

ARTICLE KEYWORDS:

bitcoin, pleb, digital monetary network, DeFi, staking, property rights, prosperity, generational wealth, purchasing power, SDR, NFT, non-fungible-token, TVL, fiat, fiat currency, inflation, deflation, CPI, sound money, store of value, debasement, absolute scarcity, limited supply, double-spend, gold, p2p, liberty, freedom, justice, honesty, public ledger, permissionless, Lightning Network, Satoshi Nakamoto, audit, free market, money, asset, time theft, monetary policy, debt, velocity of money, exponential,